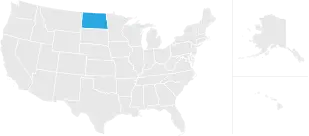

north dakota sales tax calculator

Resources Blog Reporting. Depending on local municipalities the total tax rate can be as high as 85.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

. How to Use a North Dakota Resale Certificate. The North Dakota ND state sales tax rate is currently 5. The document has moved here.

Grand Forks in North Dakota has a tax rate of 675 for 2022 this includes the North Dakota Sales Tax Rate of 5 and Local Sales Tax Rates in Grand Forks totaling 175. Usually the vendor collects the sales tax from the consumer as the consumer makes a. This top rate is among the lowest of the states that have an.

North Dakota assesses local tax at the city and county. For assistance please contact the Motor Vehicle Division at 701 328-2725. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

With local taxes the. However certain products or services in North Dakota can have a higher or lower tax. The states sales taxes stand below the national average.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Minot North Dakota and Lake Placid New York. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Just enter the five-digit zip. This means that you save the sales taxes you would. North Dakota sales tax is comprised of 2 parts.

Real property tax on median home. The sales tax is paid by the purchaser and collected by the seller. When accounting for local rates the average.

The current income tax rates are the lowest in the country ranging from 11 to 29. Although North Dakotas regular sales tax can range from. Find your North Dakota combined state and local tax rate.

Groceries are exempt from the North Dakota sales tax. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax.

North Dakota levies one of the lowest progressive state income taxes in the country with rates ranging from 110 to 290. In North Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Integrate Vertex seamlessly to the systems you already use. North Dakota has a 5 statewide sales tax rate but.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. North Dakota Salary Tax Calculator for the Tax Year 202122 You are able to use our North Dakota State Tax Calculator to calculate your total tax costs in the tax year 202122. By Sarah Craig March 21 2022.

Integrate Vertex seamlessly to the systems you already use. Avalara provides supported pre-built integration. 31 rows The state sales tax rate in North Dakota is 5000.

So whilst the Sales Tax Rate in North Dakota is 5 you can actually pay anywhere between 5 and 85 depending on the local sales tax rate applied in the municipality. RE trans fee on. Counties and cities can charge.

Sales Tax State Local Sales Tax on Food. State Sales Tax The North Dakota sales tax rate is 5 for most retail. 2022 Cost of Living Calculator for Taxes.

The North Dakota sales tax rate is 5. The 5 percent sales tax is the most common tax percent for products and services in North Dakota. If you are buying products to resell in the state of North Dakota.

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax On Grocery Items Taxjar

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Sales Taxes In The United States Wikiwand

Capital Gains Tax Calculator 2022 Casaplorer

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

North Dakota Paycheck Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Item Price 2 49 Tax Rate 4 5 Sales Tax Calculator

U S Sales Taxes By State 2020 U S Tax Vatglobal

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

North Dakota Sales Tax Rates By City County 2022

Car Tax By State Usa Manual Car Sales Tax Calculator

North Dakota Income Tax Calculator Smartasset

ميت يتصعد ساحر Tax Calculator Usa California Philosophyinpractice Net

North Dakota Sales Tax Small Business Guide Truic

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers