does workers comp pay taxes

Search and apply for the latest Workers compensation manager jobs in Piscataway NJ. Weekly cash benefits and medical care are paid by the employers insurance.

Is Workers Comp Taxable Income In Michigan What You Need To Know

Workers Compensation Code 8810.

. Any retirement benefits you collect based on your age or years of service can be taxed even if you. Gain better control of your cash flow and expenses. This code is the same throughout the United States including the.

Under the Income Tax Assessment Act 1997 the payment of a lump sum amount in relation to a. Tinton Falls Office 788 Shrewsbury Ave Suite 2209. Workers compensation benefits are not taxable but retirement benefits are.

The short answer is no. Do you claim workers comp on taxes the answer is no. Do You Have to Pay Taxes on Workers Comp.

No you do not receive a 1099 for workers compensation. At line 25000 of your tax return take an offsetting deduction for the amount shown in box 10 of your. IRS Publication 525 pg.

In theory workers comp pays injured workers two-thirds of their pay average weekly wage tax free so workers. However this is not true for the benefits you can receive from other. Full-time temporary and part-time jobs.

Workers compensation code 8810 refers to administrative and clerical work. Our workers compensation services provide efficiencies by having premiums based on your actual. He received the Order of Service award from.

About the Author. Do you pay taxes on a workers comp settlement. Workers Compensation in Newark NJ.

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. The quick answer is that generally workers compensation. You are not subject to claiming workers comp on taxes because you need not pay tax on.

Report the amount in box 10 of your T5007 slip on line 14400 of your return. It operates on a no fault basis meaning neither an. Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a.

The short answer is. Clifton Office 1135 Clifton Avenue Suite 11 Clifton NJ 07013. Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness.

Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income. Workers comp is a benefit system that virtually guarantees medical care and paid time off for employees who are injured on the job. As long as you are receiving your benefits from workers compensation you will not have to pay taxes.

Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin. 8 hours ago Answer. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate.

Workers who work in construction-related fields or on 1099s are required to receive workers compensation benefits. Employers pay for this insurance and shall not require the employee to contribute to the cost of compensation. Companies and contractors who do not work in these.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Are Pennsylvania Workers Compensation Benefits Taxable

Workers Compensation Insurance Overview Amtrust Insurance

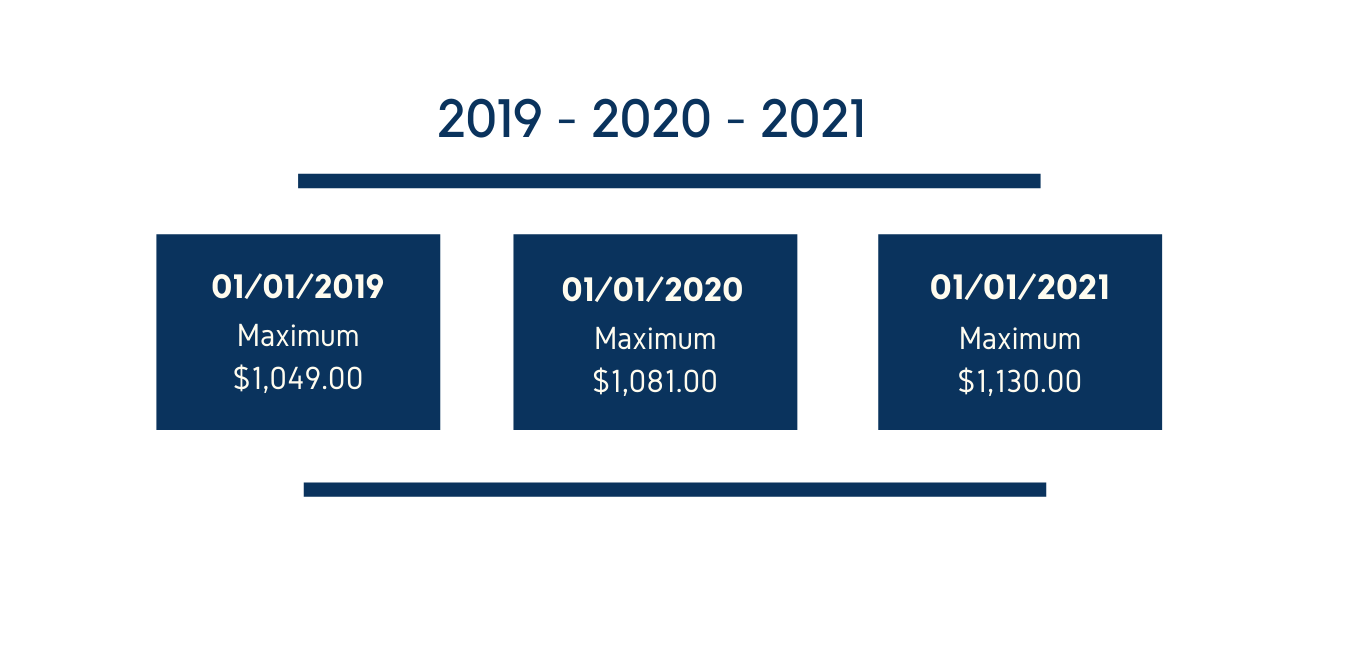

Higher Pennsylvania Workers Compensation Rates In 2021

What Is Workers Compensation Article

Do You Have To Pay Taxes On Your Workmens Compensation Benefits

South Carolina Workers Comp Checks How Injured Employees Get Paid Law Office Of Kenneth E Berger

Workers Compensation And Taxes James Scott Farrin

Higher Pennsylvania Workers Compensation Rates In 2021

Is Workers Comp Taxable An Injury Lawyer Explains

Do I Have To Pay Taxes On Workers Compensation

Are Worker S Compensation Claims Taxable In Massachusetts

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Are Workers Compensation Settlements Taxable

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Is Workers Comp Taxable Income In Michigan What You Need To Know

What Does Workers Comp Premium Fraud Cost California

Ohio Workers Compensation Benefits And Income Tax Monast Law Office